How to Read a Stock Chart for Analysis

Stock charts may seem intimidating at first, but once you understand the basics, they become one of the most powerful tools for market analysis. Whether you’re looking for entry points, exit signals, or just trying to understand a stock’s recent performance, learning how to read a chart is essential for every trader and investor.

This beginner-friendly guide breaks down the key components of stock charts and shows you how to interpret them for smarter trading decisions.

What Is a Stock Chart?

A stock chart is a graphical representation of a stock’s price movements over time. It shows how the stock’s price has changed—daily, weekly, monthly, or over years—along with trading volume and technical indicators.

Step 1: Choose the Right Chart Type

1. Line Chart

- Simplest type; shows closing prices over time.

- Great for visualizing long-term trends.

2. Bar Chart

- Displays open, high, low, and close (OHLC) prices.

- Gives more detail than line charts.

3. Candlestick Chart (Most Popular)

- Shows OHLC in a color-coded, visual format.

- Green candles = price went up; Red candles = price went down.

- Best for identifying patterns and trends.

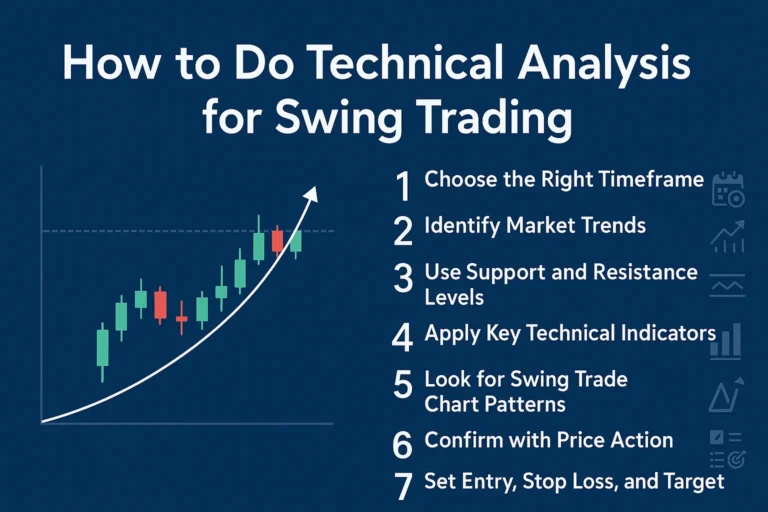

Step 2: Understand Timeframes

Timeframes determine how much data each candle or bar represents:

- 1-Min, 5-Min, 15-Min: For intraday traders

- 1-Hour, 4-Hour: For swing traders

- Daily, Weekly, Monthly: For long-term investors

The timeframe you choose should match your trading style.

Step 3: Read Price Action

Look for:

- Trend direction: Is the stock going up, down, or sideways?

- Support levels: Prices where the stock tends to bounce up

- Resistance levels: Prices where the stock tends to reverse down

- Breakouts: When price moves above resistance or below support

Step 4: Use Technical Indicators (Optional)

Many traders use indicators to confirm trends or spot trade setups:

- Moving Averages (MA) – Smooths price trends (e.g., 50-day MA)

- Relative Strength Index (RSI) – Measures overbought/oversold levels

- MACD – Shows momentum and trend shifts

- Bollinger Bands – Indicates volatility and breakouts

These can be added on platforms like TradingView, Yahoo Finance, or Investing.com.

Step 5: Identify Common Chart Patterns

Patterns often repeat and can signal future price moves:

| Pattern | Meaning |

|---|---|

| Head and Shoulders | Potential trend reversal |

| Double Top / Bottom | Reversal pattern |

| Ascending Triangle | Bullish breakout |

| Descending Triangle | Bearish breakout |

| Cup and Handle | Continuation of uptrend |

Learning to recognize these improves timing and confidence.

Step 6: Observe Volume

Volume shows how many shares were traded and helps validate price moves:

- High volume = strong conviction

- Low volume = weak moves, possible fakeouts

- Breakouts with high volume are more reliable.

Step 7: Practice Reading Real Charts

The best way to learn is by observing charts daily. Use platforms like:

Try paper trading based on chart setups before using real money.

Conclusion

Reading stock charts is not about predicting the future—it’s about understanding what the market is doing now. Mastering charts helps you make more informed decisions, spot opportunities, and manage risk better.

Start with the basics, keep practicing, and over time, you’ll develop an instinct for reading market movement just like a pro.

FAQs

1. Which chart type is best for beginners?

Candlestick charts are the most widely used and informative for traders.

2. What’s the best timeframe for stock chart analysis?

It depends. Use daily or weekly charts for investing, and 5-min or 15-min charts for day trading.

3. How can I tell if a trend is strong?

Look for consistent higher highs/higher lows and confirm with volume and moving averages.

4. Do I need technical indicators to read charts?

Not necessarily. Price action and volume alone are powerful if interpreted correctly.

5. Is chart reading enough to trade successfully?

It’s one part of the puzzle. Combine with risk management, strategy, and market awareness.