Technical vs Fundamental Analysis: Which One Is Better?

When it comes to analyzing stocks or other financial assets, investors often fall into two camps—technical analysis and fundamental analysis. But which one is better? The answer depends on your goals, time horizon, and trading style.

In this guide, we’ll explore the differences between technical and fundamental analysis, compare their pros and cons, and help you decide which one is right for your strategy in 2025.

What Is Fundamental Analysis?

Fundamental analysis involves evaluating a company’s financial performance, business model, industry position, and intrinsic value.

Key focus areas include:

- Revenue and earnings growth

- Profit margins and debt levels

- Valuation ratios (P/E, P/B, PEG)

- Management quality

- Competitive advantage

- Macroeconomic and sector trends

Goal: Determine whether a stock is undervalued or overvalued relative to its true worth.

Best for:

- Long-term investors

- Value investors

- Buy-and-hold strategies

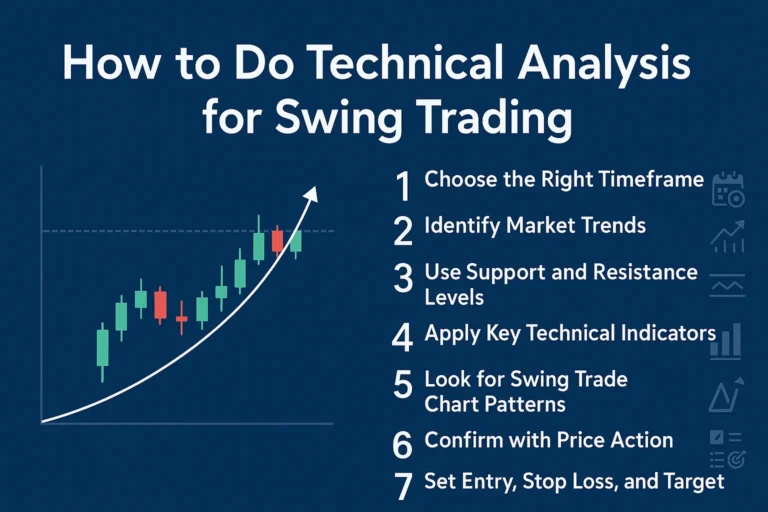

What Is Technical Analysis?

Technical analysis focuses on studying price movements, patterns, and volume data using charts and indicators.

Key tools include:

- Candlestick patterns

- Moving averages (SMA, EMA)

- RSI, MACD, Bollinger Bands

- Support & resistance levels

- Trendlines and chart patterns

Goal: Forecast short-term price direction based on market behavior.

Best for:

- Day traders

- Swing traders

- Momentum-based strategies

Key Differences: Technical vs Fundamental

| Feature | Fundamental Analysis | Technical Analysis |

|---|---|---|

| Focus | Financial data, valuation | Price charts, volume |

| Time Horizon | Long-term | Short- to mid-term |

| Tools Used | Financial statements, ratios | Indicators, patterns |

| Approach | Company performance | Market psychology |

| Used by | Investors | Traders |

Pros & Cons of Fundamental Analysis

Pros:

- Helps identify undervalued long-term opportunities

- Provides insight into business quality

- Based on objective financial data

Cons:

- Doesn’t help with short-term timing

- Time-consuming and requires more research

- May miss momentum opportunities

Pros & Cons of Technical Analysis

Pros:

- Great for short-term trading

- Offers entry and exit timing

- Easy to automate and test strategies

Cons:

- Ignores company fundamentals

- Can generate false signals in sideways markets

- Requires discipline and practice

Which One Is Better?

There’s no one-size-fits-all answer. Here’s a quick guide:

| If You Are… | Use This Approach |

|---|---|

| A long-term investor | Fundamental analysis |

| A swing or day trader | Technical analysis |

| A position trader | Both (hybrid strategy) |

| Looking to time your entry | Technical indicators |

| Choosing between companies | Fundamental metrics |

Can You Combine Both?

Yes! Many successful investors use a hybrid approach:

- Use fundamental analysis to select strong stocks.

- Use technical analysis to decide the best time to buy or sell.

Example: Buy a fundamentally strong stock (good earnings, low debt) when it breaks above resistance on strong volume.

Conclusion

Both technical and fundamental analysis are powerful in their own ways. The key is to align the method with your goals and trading style. Whether you want to invest for the long haul or trade on short-term signals, understanding both gives you an edge in the market.

FAQs

1. Can I rely only on technical analysis?

Yes, especially for short-term trades. But long-term investors should include fundamentals.

2. What’s the biggest mistake beginners make?

Relying on just one type without understanding the context or timeframe.

3. Are there tools that combine both?

Yes, platforms like TradingView, Finviz, and Simply Wall St offer both charting and financial data.

4. Which is easier to learn for beginners?

Technical analysis is often easier to start with, while fundamentals require deeper understanding.

5. Should I use different strategies for different stocks?

Absolutely. Tech stocks may need momentum-based strategies, while value stocks favor long-term fundamentals.