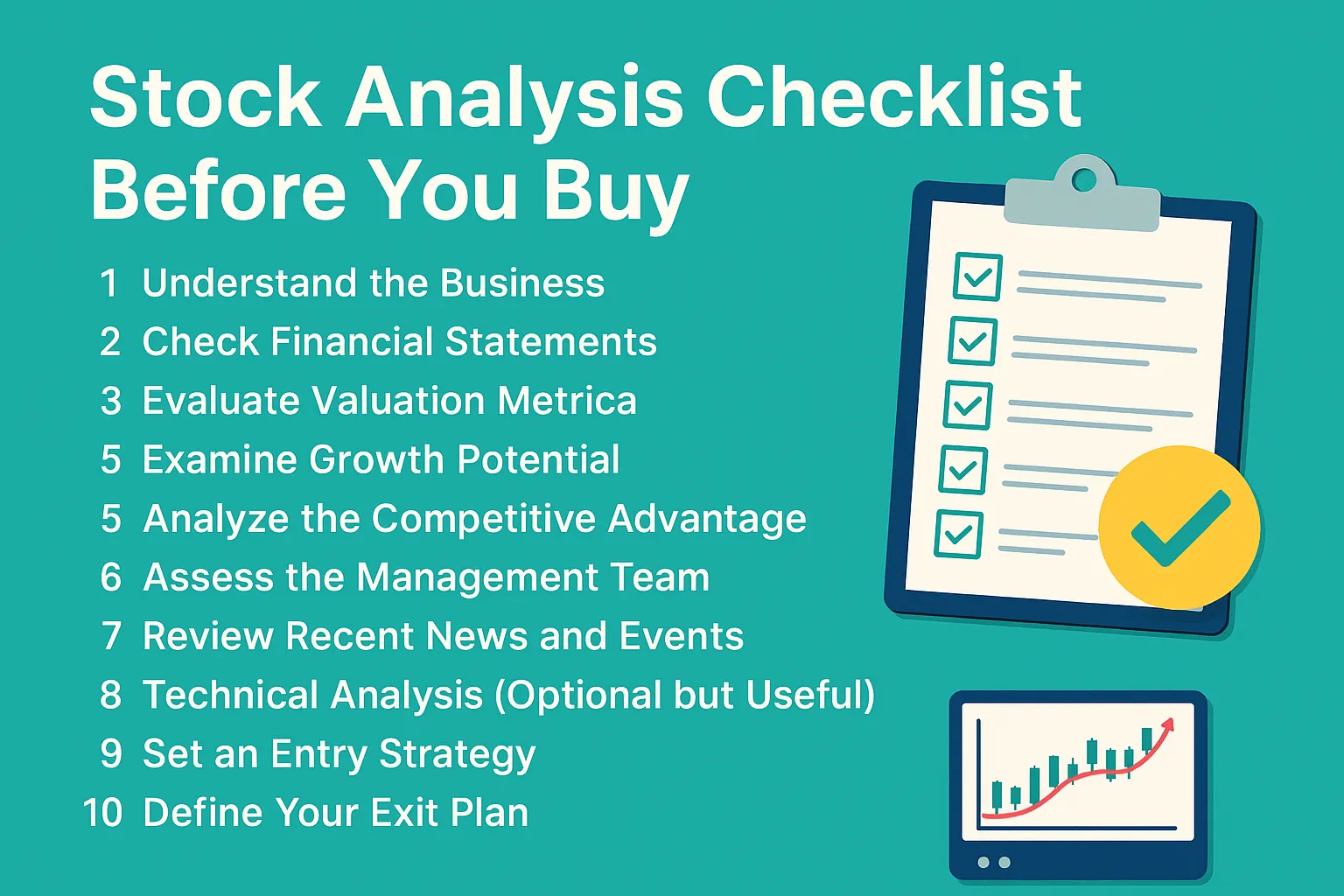

Stock Analysis Checklist Before You Buy

Before you buy a stock, it’s crucial to perform a thorough analysis to avoid costly mistakes. A disciplined approach to evaluating a stock can improve your investment outcomes and reduce emotional decision-making. This post outlines a practical stock analysis checklist every investor should go through before making a buy decision.

1. Understand the Business

Before anything else, make sure you understand what the company does. Ask:

- What is their core business model?

- Who are their customers?

- What industry or sector do they operate in?

- Is it a cyclical or defensive business?

If the company’s product or service is hard to explain, it’s best to dig deeper or move on.

2. Check Financial Statements

Look into the company’s financial health using key financial documents:

- Income Statement: Is the company profitable? Look for consistent revenue and earnings growth.

- Balance Sheet: Assess debt levels, cash reserves, and overall asset strength.

- Cash Flow Statement: Ensure the company is generating positive operating cash flow.

3. Evaluate Valuation Metrics

Use these ratios to understand whether the stock is fairly valued:

- P/E Ratio (Price-to-Earnings)

- PEG Ratio (Price/Earnings to Growth)

- P/B Ratio (Price-to-Book)

- Dividend Yield and Payout Ratio (if applicable)

Compare these to industry peers and historical averages.

4. Examine Growth Potential

- Is the company in a growing industry?

- Are there expansion plans, new product lines, or geographic growth?

- Check earnings projections and analyst expectations.

Strong future growth is key to long-term stock appreciation.

5. Analyze the Competitive Advantage

Ask if the company has a moat—something that sets it apart:

- Brand recognition

- Patents or proprietary technology

- Network effects

- Cost leadership or economies of scale

Companies with strong moats tend to outperform competitors over time.

6. Assess the Management Team

Review the leadership:

- Is the management experienced and consistent?

- What is their track record in delivering results?

- Do they hold a significant stake in the company?

Good leadership can steer a company through challenging periods.

7. Review Recent News and Events

Look out for:

- Recent earnings reports

- M&A activity

- Legal issues

- Regulatory changes

- Macroeconomic factors affecting the sector

These can significantly impact short- to mid-term performance.

8. Technical Analysis (Optional but Useful)

Even for long-term investors, technical indicators can help with entry timing:

- Support and resistance levels

- Moving averages (50-day, 200-day)

- RSI or MACD to identify overbought/oversold zones

- Volume trends

Buy decisions are stronger when both fundamental and technical signals align.

9. Set an Entry Strategy

Don’t buy impulsively. Instead:

- Set a target buy price

- Consider dollar-cost averaging if it’s a volatile stock

- Have a maximum amount you’re willing to invest

This helps avoid emotional decisions.

10. Define Your Exit Plan

Before you buy, know when you’ll sell:

- Profit-taking level (e.g., 20% gain)

- Stop-loss threshold (e.g., 10% decline)

- Event-driven exit (e.g., earnings miss or industry change)

Having rules in place keeps your trading disciplined.

Conclusion

Investing in stocks isn’t about chasing hot tips. It’s about consistent, repeatable research and analysis. By following this stock analysis checklist, you’ll make better-informed decisions and avoid common investing pitfalls.

FAQs

1. Should I use both fundamental and technical analysis before buying a stock?

Yes, combining both helps you understand the business and time your entry better.

2. How often should I update my stock analysis?

Review it quarterly or whenever major news or earnings are released.

3. Is it okay to buy a stock based on analyst ratings?

Use analyst opinions as guidance, not as the sole reason for buying.

4. What’s a good P/E ratio for buying a stock?

This varies by sector. Compare with industry averages for better context.

5. How do I know if a company’s debt is too high?

Look at the debt-to-equity ratio and compare it with peers in the same industry.